Iron ore futures have surged to a fresh peak, surpassing the $130 per ton mark. The uptick in prices is primarily fueled by robust profitability and optimistic demand projections in China. To counteract hoarding activities, the Chinese government has implemented measures like elevating port storage charges for substantial shipments and issuing admonitions to traders.

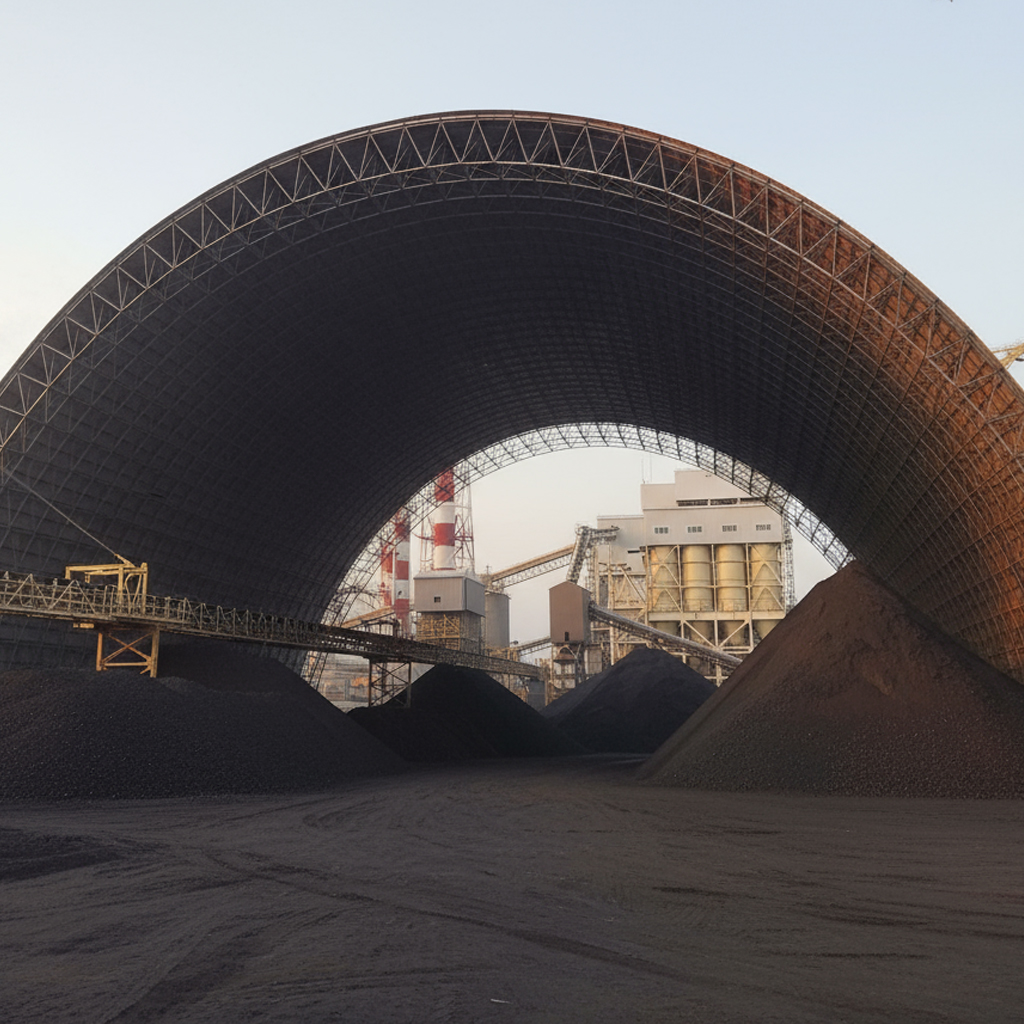

Delve into the future of iron ore storage as prices surge to new heights, driven by robust profitability and optimistic forecasts in China. Explore the measures taken by Chinese authorities to counteract hoarding activities and navigate the evolving landscape of the iron ore market. Gain insights into the expanding iron ore market, driven by rising construction activities and increasing demand fueled by healthcare expenditure.

What to Read in this Blog:

- Gain an understanding of the factors driving the surge in iron ore prices and the implications for stakeholders in the steel industry.

- Explore the strategies implemented by Chinese authorities to regulate iron ore stockpiling and their impact on market dynamics.

- Discover key trends and driving forces shaping the future of the iron ore market, including rising construction activities and healthcare expenditure.

- Gain insights into the evolving landscape of the iron ore market and its implications for stakeholders across various sectors.

Overview

The future of iron ore storage continues their steady ascent, with the Singapore benchmark surpassing $130 per ton. This surge is primarily attributed to enhanced profitability in steel plants and optimistic demand forecasts in China, the world’s largest steel producer. Despite these price hikes, concerns over regulatory measures serve as a limiting factor.

The most actively traded May iron ore contract on China’s Dalian Commodity Exchange closed daytime trading 0.5% higher at $134.63 (equivalent to 929 yuan) per ton. This uptick follows the commodity’s fifth consecutive weekly gain, as reported by Reuters. Meanwhile, on the Singapore Exchange, the benchmark April contract for iron ore climbed 2.5% to $132 per ton, marking its highest level.

Boosted Iron Ore Prices Supported by Steel Industry Forecasts

The rise in the price of iron ore is attributed to optimistic forecasts in the steel sector. The main driver behind this increase is the widespread belief among industry participants that this will be a favorable year for Chinese steel mills. Buoyed by improved profits and a positive outlook for the domestic economy, Chinese steelmakers are making decisive moves. Many have ramped up production or resumed operations following extended maintenance phases.

Fortescue Metals of Australia recently projected heightened demand for iron ore in the upcoming year. The company pointed to China’s backing of its property and construction sectors as a key factor. Fortescue noted a “really good” demand for its lower-grade iron ore post-Chinese New Year, despite squeezed margins with steelmakers, according to Chief Executive Fiona Hicks.

Experts anticipate a rebound in the real estate market, supported by relative stability in sectors such as automobiles and shipping. This heightened demand is expected to lead to increased imports of iron ore and coking coal from various countries, including Australia, potentially influencing the price of iron ore.

The China Automobile Dealers Association has already forecasted a rise in car sales to approximately 28 million units, similar to pre-COVID levels. Meanwhile, the World Steel Association has projected global steel consumption to reach 1.814 billion tons, with China accounting for roughly half of this total.

Chinese Authorities Take Measures to Combat Iron Ore Stockpiling

Regardless of the circumstances, Chinese authorities are already implementing strategies to address iron ore hoarding. The Bloomberg Report reveals that Beijing issued warnings to trading firms, cautioning against the accumulation of large volumes of iron ore at ports. Additionally, there are discussions about increasing port-storage fees for bulk shipments. China’s National Development and Reform Commission (NDRC) convened with industry experts to explore methods to mitigate “excessively rapid” price surges. The NDRC plays a pivotal role in monitoring not only iron ore prices but also market fluctuations in commodities like coal, soybeans, and others.

Meanwhile, China’s iron ore imports surged by 7.3% last year, compared to the previous year. Customs Department data indicates that China imported 194 million tons of ore in January and February of 2023 significantly surpassing the 181.1 million tons imported during the same period in 2022.

Expanding Iron Ore Market: Driving Forces and Trends

The iron ore market anticipates substantial growth in the coming years, reaching $598.03 billion in 2028 with a compound annual growth rate (CAGR) of 7.1%. This growth is attributed to increasing urbanization, rising healthcare expenditure, and the burgeoning residential sector. Notable trends in this period include the development of innovative technological tools using advanced technologies, the introduction of innovative decarbonization technologies, the establishment of advanced iron ore hubs, collaboration with contemporary companies, launching new digital tools, and leveraging automation in mining processes.

Rising Construction Activities Fuel Iron Ore Market Growth

The iron ore market is expected to witness significant expansion due to escalating construction activities. Construction involves assembling various elements to create structures for specific locations using detailed designs and plans. Iron ore plays a vital role in steel production, a primary construction material used in buildings, bridges, and roads. Notably, building activities increased by 3.7% in March 2021, with residential activities rising by 4.3% compared to 2020. The value of construction activities surged from $1,626.4 billion in 2021 to $1,792.9 billion in 2022, registering a growth rate of 10.2%. Thus, the burgeoning construction sector drives the growth of the iron ore market.

Increasing Iron Ore Demand Driven By Rising Healthcare Expenditure

Rising healthcare expenditure is anticipated to propel demand in the iron ore market. Healthcare expenditure encompasses all expenses for providing health services, family planning, nutrition, and emergency aid. Steel, derived from iron ore, is a predominant material in medical equipment due to its durability and cleanliness, crucial in healthcare settings. Forecasts predict a 5.1% annual increase in national health spending between 2021 and 2030 in the USA, reaching approximately $6.8 trillion by 2030. Medicare expenditures are expected to expand at a 7.2% annual rate, while Medicaid spending is projected to grow at a 5.6% annual rate during the same period. Consequently, the surge in healthcare expenditure contributes to the growth trajectory of the iron ore market.

Navigating the Iron Ore Market in 2024

While Chinese economic recovery has fallen short of expectations, Chinese hot metal production remained resilient in 2023. The global iron ore markets will continue to witness fluctuating growth trends in 2024, as policy volatility in China remains a key driver. On the supply side, miners’ investments will strengthen product portfolios, lead to decarbonizing mine sites, support acquiring new technologies, and leverage capabilities to maintain growth.

Exploring Key Themes

- China’s Economic Outlook: Assessing the prospects for China’s economy in 2024, considering a lackluster recovery in 2023. Should we adopt a pessimistic outlook or cautiously embrace optimism?

- Supply Complexity: Delving into the challenges of mine development, particularly as steelmakers seek higher-grade ore, adding complexity to supply chains.

- Simandou Project: Examining factors that could impede the pace of progress in 2024 for this significant iron ore project.

- China’s Global Influence: Analyzing the performance of Chinese domestic iron ore production against targets and the expanding influence of CMRG (China Mining and Resources Group) on the global stage.

- Decarbonization Initiatives: Exploring the acceleration in the adoption of new technologies, leading to the emergence of green production hubs and their implications for the iron ore market’s future.

Conclusion

As we navigate the complexities of the iron ore market, it’s clear that demand dynamics, regulatory measures, and technological advancements will continue to shape its trajectory. With rising construction activities and healthcare expenditure driving demand, alongside efforts to combat hoarding and promote sustainability, the future of iron ore storage holds both challenges and opportunities for industry players worldwide.